In today’s fast-paced insurance industry, success depends on two things: consistency and personalization. Whether you’re a solo agent or managing a full agency team, GoHighLevel (GHL) offers powerful automation tools that let you scale smarter—not harder.

This article breaks down the top 7 automations every insurance agency should implement in GoHighLevel, with step-by-step tips, real-world examples, and why each one matters for retention, lead generation, and closing more policies.

Quick Takeaways

- Automations reduce time spent on repetitive tasks like appointment reminders and follow-ups.

- You can build powerful drip sequences for new leads using GHL workflows.

- GoHighLevel’s Conversation AI and Custom Objects make insurance-specific workflows easier.

- Trigger actions like cross-sell prompts after a policy renewal automatically.

- Workflow AI lets you personalize client communications while scaling outreach.

- Custom Pipelines help agents visualize sales stages, renewals, and more.

- GHL’s A2P compliance automation ensures SMS deliverability and legal compliance.

1. New Lead Nurture Workflow

Why it matters: Most leads go cold within hours if not contacted. This automation keeps you top of mind from the moment a lead opts in.

How to set it up:

- Trigger: Form submission or Facebook Lead Ad integration

- Actions:

Immediate SMS: “Thanks for reaching out! When’s a good time to chat?”

Wait 5 mins → Email with agency introduction

Wait 1 day → Follow-up call task for agent

Continue with a 5-day email/SMS drip sequence

Pro tip: Use GoHighLevel’s Custom Values to personalize every message automatically.

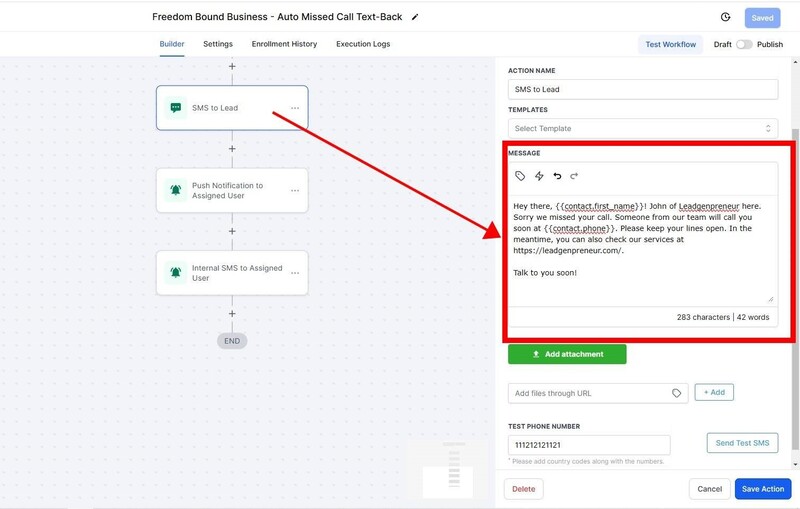

2. Missed Call Text Back Automation

Why it matters: Agents are busy, but leads expect instant responses. This automation replies to missed calls immediately—saving opportunities.

How to set it up:

- Trigger: Missed call

- Action: SMS: “Sorry, we missed your call! How can we help?”

This one takes 2 minutes to set up and pays off forever.

3. Appointment Reminder & Reschedule Flow

Why it matters: No-shows hurt productivity and waste valuable time.

Setup steps:

- Trigger: Appointment booked in the calendar

- Actions:

- 24-hour reminder via SMS + Email

- 2-hour reminder via SMS

- Include a dynamic reschedule link if the client can’t make it

You can find this in the GoHighLevel Calendar workflows section or create your own with custom timing.

4. Policy Renewal & Cross-Sell Campaign

Why it matters: Most leads go cold within hours if not contacted. This automation keeps you top of mind from the moment a lead opts in.

How to set it up:

- Trigger: Form submission or Facebook Lead Ad integration

- Actions:

Immediate SMS: “Thanks for reaching out! When’s a good time to chat?”

Wait 5 mins → Email with agency introduction

Wait 1 day → Follow-up call task for agent

Continue with a 5-day email/SMS drip sequence

Pro tip: Use GoHighLevel’s Custom Values to personalize every message automatically.

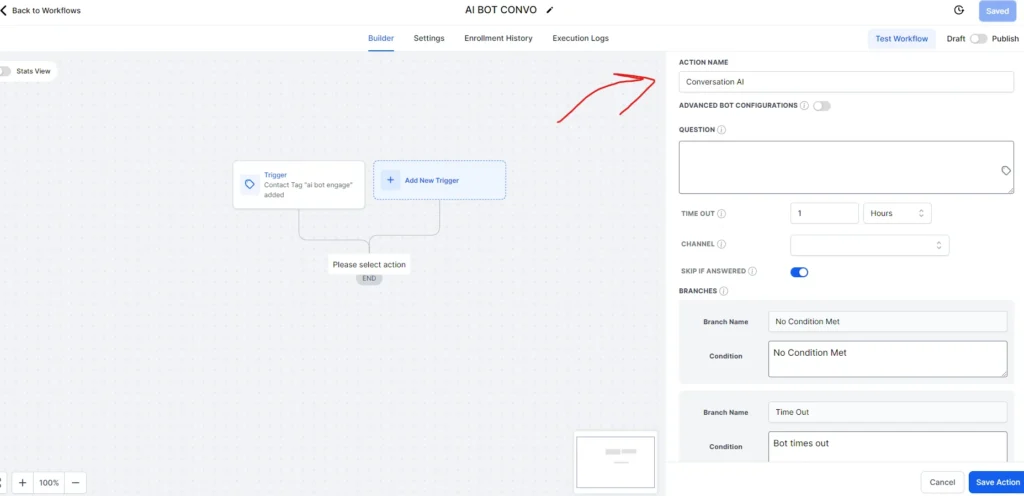

5. Conversation AI for FAQs & Appointment Booking

Why it matters: Your team can’t answer every message—but GoHighLevel’s AI can.

Setup tips:

- Enable Conversation AI in sub-account settings

- Train it with your FAQs and appointment booking script

- Set the AI mode to autopilot for automated responses across SMS, Web Chat, IG, FB, and Google Business Chat

💡 Combine this with a workflow to assign follow-up tasks if the AI can’t resolve an issue.

6. Pipeline Automation for Opportunity Stages

Why it matters: Manually moving leads in your CRM = missed updates. Automate it!

How to build it:

- Trigger: Stage changes in your Opportunity Pipeline

- Action Ideas:

- Moved to “Quoted”? → Send email with policy comparison.

- Moved to “Won”? → Trigger welcome email + review request.

- Moved to “Lost”? → Trigger feedback survey.

You can create insurance-specific pipelines like “Auto Quote → Underwriting → Bound” in GoHighLevel Pipelines.

7. A2P Compliance Workflow

Why it matters: Without A2P registration, your SMS might get blocked or penalized.

Automate compliance reminders:

- Trigger: New client with a US number

- Action: Check if their number is registered for A2P

- If not, send an internal task or email to the agency to register

Stay compliant by using GoHighLevel’s in-platform A2P registration support.

Frequently Asked Questions

Can I use GoHighLevel with my existing insurance CRM?

What’s the best plan for automation features?

How do I handle A2P SMS registration?

Can I create my own lead nurture templates?

Final Thoughts

Insurance automation isn’t about removing the human element—it’s about making more time for human connection where it matters most. GoHighLevel empowers insurance agencies to automate the boring stuff so you can focus on closing policies, building relationships, and growing revenue.

By implementing even just a few of these 7 automations, you’ll be setting your agency up for better lead handling, smarter follow-up, and smoother client experiences.